Author | Source

Severin Renold

Weissknight Corporate Finance

McKinsey

Severin Renold

Weissknight Corporate Finance

McKinsey

Connected Mobility

The global automobile industry is on the brink of a vital transformation. Technology is driving this shift, shaped by demographic, regulatory and environmental pressures.

Mobility management has developed into a multi-billion $ industry in Europe and around the world in recent years.

More importantly, connected vehicle data continues to grow and is gaining significant strategic importance in a world of changing mobility. I.e. firstly, the trend towards sharing instead of owning, and secondly, the trend towards self-driving vehicles and electrification.

For example fleet management enables enterprises to track and maintain their vehicles in a cost-effective, quick, and accessible way. It involves functions such as vehicle tracking & diagnostics, financing, driver management, and others. It helps business organizations that depend significantly on transportation to lower or completely eliminate the risks associated with staff cost, operations, and others. Reduced fuel & overall running costs, enhanced safety, and optimized fleet operations, with real-time fleet tracking and monitoring, are the benefits offered by fleet management, which covers only a small part of the overall mobility transformation. However, fleet management is part of the solution towards some of the megatrends in the automotive industry, which will be outlined in the following chapters!

A connected car is known to be a vehicle that can communicate bi-directionally with other systems outside of the car. It is armed with internet connectivity and, in several cases, a WLAN. This permits the car to download software and patches, contact and share data, connect with other internet of things (IoT) devices, and offer Wi-Fi for on-board passengers.

Connected cars provide a unique customer experience while simultaneously delivering cost and revenue benefits to mobility companies, including OEMs, suppliers, dealers, insurers, fleets, tech players, and beyond.

The global connected car market was valued at $ 63 billion in 2019 and is projected to reach $ 225 billion by 2027, registering a CAGR of 17.1%.

Analysts predict that worldwide sales of connected vehicles will reach 76.3 million units within two years, meaning nearly 70% of worldwide new light-duty cars and trucks will ship with embedded connectivity.

The connected car technology of the near future will be a digital platform that uses a multitude of sensors, such as radar, LIDAR, cameras, ultrasonic sensors, and vehicle motion sensors to safely transport passengers and goods. Inside the vehicle, connected cars will provide immersive experiences, in some cases turning the interior of vehicles into virtual theme parks through extended reality (XR) technology. Connected car facilitates connectivity on wheels offering comfort, convenience, performance, safety, and security along with powerful network technology. This enables the driver to connect with online platforms, thereby facilitating real-time communication and sustainability.

Smartphones have changed the definition of connectivity over time. People wish to stay connected with the outer world even while travelling. Now that connectivity has become the need of the hour, automobile manufacturers adopt connectivity solutions in their vehicles to boost their automobile sales. Consumers are expecting their vehicles to perform tasks similar to computers and smartphones.

The automotive data monetization is segmented into on-premises and cloud.

Cloud-based solutions have become the most essential technology for many business professionals across the globe for several simple to complex operations.

The Mobility industry is one of the complex environments that have witnessed rapid technological growth in the last decade.

Cloud-Based Solutions Market designed for all aspects of Mobility is segmented on the basis of deployment type, application, vehicle type and region. Based on deployment type the global market is segmented into private cloud and public cloud. Based on application type the market is divided into Fleet management, infotainment, over-the-air (OTA) updates, telematics, ADAS and other services.

Mobility Cloud-Based Solutions facilitates the flow of data generated from the vehicle, vehicle users and surrounding environment around vehicle and processes the data in order to provide actionable insights, decisions, or tasks to the user.

The Global Electric Vehicle Market size is projected to grow from 4,093 thousand units in 2021 to 34,756 thousand units by 2030, at a CAGR of 26.8% according to MarketsandMarkets. Factors such as growing demand for low emission commuting and governments supporting long range, zero emission vehicles through subsidies & tax rebates have compelled the manufacturers to provide electric vehicles around the world. This has led to a growing demand for electric vehicles in the market. Countries around the world have set up targets for emission reductions according to their own capacity.

Increasing investments by governments across the globe to develop EV charging stations and Hydrogen fueling stations along with incentives offered to buyers will create opportunities for OEMs to expand their revenue stream and geographical presence. The market in Asia Pacific is projected to experience steady growth owing to the high demand for lower cost-efficient and low-emission vehicles, while the North American and European market is fast-growing markets due to the government initiatives and growing high-performance Passenger vehicle segment. However, the low presence of EV charging stations and hydrogen fuel stations, higher costs involved in initial investments, and performance constraints could hamper the growth of the global electric vehicle market. In addition, there is still no comprehensive solution that covers all aspects of the 4 ACES and is accessible as a one-stop shop solution, whereby the number of API interfaces to vehicle data, process data and charging infrastructure in connection with real-time IOT plays an essential role, especially for commercial and public purposes.

Summary of the EV market dynamics

Due to technological advancements and the production of EV batteries on a mass scale in large volumes, the cost of EV batteries has been decreasing over the past decade. This has led to a decrease in cost of the electric vehicles as EV batteries are one of the most expensive parts of an electric vehicle. In 2010, the price of an EV battery was around USD 1,100 per kWh. However, by 2020 their price fell to around USD 137 per kWh while the price is as low as USD 100 per kWh in China. This is because of reducing manufacturing costs of these batteries, reduced cathode material prices and greater volumes of production, etc. The prices of EV batteries are expected to fall to around USD 60 per kWh by 2030, which will greatly reduce the price of EV’s making them cheaper than conventional ICE vehicles.

There is a low number of EV charging stations in many countries around the world. This makes the possibility of public EV charging less thereby reducing the demand for electric vehicles. Although many countries are working on developing EV charging infrastructure, most countries haven’t been able to develop an appropriate number of EV charging stations except in some states. The demand for EV’s will increase once there is a well-developed EV charging network across the world. Most countries are yet to develop such charging networks across their region. The Netherlands has the highest EV charger density per 100 km’s.

Countries around the world have set up targets of around 2050 to reduce vehicle emissions. They have started promoting the development and sales of EV’s and related charging infrastructure. For instance, the US government invested USD 5 billion in 2017 to promote electric vehicle infrastructure such as charging stations. Several governments are providing various kinds of incentives such as low or zero registration fees and exemptions from import tax, purchase tax, and road tax. Furthermore, countries such as Norway and Germany are investing significantly in promoting sales of EVs. Thus, due to the large incentives and subsidies in Europe, a high growth rate in the sale of electric vehicles is observed. This has led to the growth in the demand for components and equipment associated with EV charging operations such as charging cables, connectors, adapters, and portable chargers. Also, as part of a partnership between the US departments of energy and transportation, a 2020 vision for a national fast-charging network has been developed, with potential longer-term innovations which include up to 350 kW of direct current fast charging. Stringent CO2 emission norms have increased the demand for electric vehicles. Governments are investing significantly in providing incentives and subsidies to encourage sales of EVs. These steps taken by governments around the world will help in increasing demand for EV’s in the coming decade.

Factors such as the growth of the electric vehicle market and variation in charging loads have emphasized the need for the standardization of electric vehicle charging stations as well as the corresponding underlying platform and software solution. Certain EV charging stations may only be compatible with a certain type of voltage. For instance, AC charging stations provide a voltage of 120V AC through level 1 charging stations and 208/240V AC through level 2 charging stations. On the other hand, DC charging stations provide fast charging through 480V AC. Governments need to standardize charging infrastructure for the development of a favorable ecosystem and an increase in the sales of EVs. Though, this mandate increased the installation cost of charging stations and hence in July 2019, the government changed the guidelines and allowed charging station developers to choose the method they prefer. US-based electric car maker Tesla uses high-performance superchargers that are unique to Tesla and cannot be used for other EVs (which might change in the near future). The lack of standardization across countries may impact the installation of charging stations and hamper the growth of the Electric Vehicle Charging Station market.

The electric vehicle market for passenger cars is largest in Asia Pacific followed by Europe and North America. In Asia, China, Japan and South Korea are the countries leading the passenger EV market in the region. This is due to the strong government support for passenger EV’s in these countries. Germany, France, Netherlands, Norway, Sweden, UK, etc. are the top countries in the European region with a growing demand for EV passenger vehicles. These countries have come out with string of emission regulations and a variety of subsidies, grants and incentives for shifting to EV’s. in 2020, due to these measures, Europe’s EV sales went beyond China’s EV sales. North America is also increasing EV passenger car demand with various states in US and Canada leading the electrifying trend. MEA countries have started to increase their EV’s market and are expected to be the fastest-growing market in the coming years.

Those who succeed in breaking down these silos will make an important contribution to simplifying and implementing sustainable electrification and accelerating mass adoption. This also goes hand in hand with the consumer shift from a seller’s to a buyer’s market and today’s trend to use goods and services cost-efficiently and sustainably in the short term to satisfy a specific need. Therefore, the idea of ownership is increasingly fading into the background in favour of shared services. Airbnb, Uber and WeWork are just a few prominent examples of this shift and especially in the transport/mobility and logistics sector (with almost no industry directly excluded), we see increased initiatives to further promote this. These include car, bike, scooter and other shared services, which should contribute to providing sustainable and cost-efficient solutions for reducing CO2 emissions in cities and suburban areas, reducing traffic congestion and making transport and mobility smarter, and also promoting safety and maintenance in the context of connected and autonomous vehicles.

The shared mobility trend

According to McKinsey’s 2020 ACES consumer survey, more than 60 percent of people would share their shared-mobility ride with a stranger if doing so would add less than 15 percent to their travel time while reducing their cost. In recent years, new modes and services have emerged, such as pooled ridesharing with strangers, peer-to-peer car sharing (driving a stranger’s private car), and shared electric scooters, pointing to a sizable potential market in the mobility space. The next big things include autonomous taxis (so-called robo-taxis) and airborne varieties, which have seen a huge investment acceleration and traction in recent months.

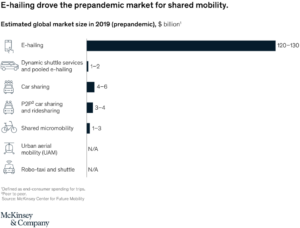

The shared-mobility market accounted for approximately $130 billion to $140 billion in global consumer spending in 2019. Out of this, e-hailing accounted for the largest share, $120 billion to $130 billion, which is more than 90 percent of the total market. Taken together, car sharing and peer-to-peer car sharing account for less than 10 percent of this market, which reflects e-hailing’s higher convenience (that is, the customer is driven, can spend the time in the vehicle on other activities, and does not have to find a parking space).

McKinsey’s forecast shows micromobility could reach a consumer-spending potential of $300 billion to $500 billion globally by 2030 (combining shared and private micromobility), thus becoming three to four times larger than today’s global e-hailing market. This amount could grow even higher as the pandemic winds down and normal activities resume.

Since 2010, more than $100 billion has been invested in shared-mobility companies. Looking deeper into types of investors, it’s not the automotive players that are investing in shared-mobility companies. Instead, around 72 percent of the total amount of disclosed investment since 2010 has come from venture capital and private-equity players, suggesting a bet on the future rather than on established and already sustainable business models. Tech players are second at approximately 21 percent, while automotive-company investments amount to approximately 4 percent. One reason for the traditional automotive industry’s lackluster showing could involve shared mobility’s potential for disrupting an automotive player’s core business. Some automotive OEMs have attempted to face the challenge through in-house initiatives rather than investments in external, new startups. This displays a mindset shift from selling vehicles to providing shared-mobility services, while the latter may even cannibalize OEMs’ core business of selling cars to private individuals.

Survey respondents said that their main reason for using shared mobility is convenience. This reflects today’s dominance of e-hailing over other shared-mobility modes. The most important features of shared-mobility services for consumers are safety, a competitive price, and availability. The latter, especially, might be an important factor in shared mobility’s ability to replace private-car ownership in the long term. Notably, availability is the most important feature for German consumers.