Author | Source

Severin Renold

Weissknight Corporate Finance

Severin Renold

Weissknight Corporate Finance

BioTech, Gene Therapy

Serious diseases have traditionally been treated using drug therapy, which aims to manage the disease rather than cure it. More recently, advanced gene-therapy products, such as lentiviral vectors, have been used to permanently restore health to those suffering from severe disease.

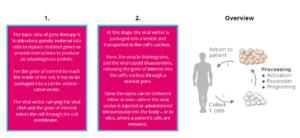

The basic idea of gene therapy is to introduce genetic material into cells to replace mutated genes or provide instructions to produce an advantageous protein.

For the gene of interest to reach the inside of the cell, it has to be packaged into a carrier vehicle. Mostly, these vehicles are viral vectors, but there are also non-viral carriers. Viral vectors are most often used as carriers because they can deliver the gene of interest with high efficiency using the natural mechanism for infecting cells. The viral vectors are engineered, so they are incapable of causing disease in humans. In gene therapy, the viral vector is composed of the capsid, the virus’s protein shell that carries the genetic material and envelope proteins that allow for binding and entry into the targeted cell.

Gene Therapy Delivery Vehicles:

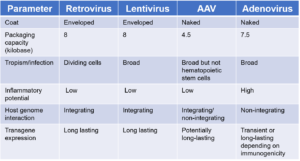

The inability of viruses to self-replicate unless they infect a living cell is a fundamental reason they have become so valuable for gene therapy development. In essence, viral vectors are modified viruses that contain the viruses’ gene delivery skills while their pathogenic characteristics have been removed. A number of viral vectors have been developed to introduce genetic material into target cells. In gene therapy, the cargo can either replace a mutated, disease-causing gene with a healthy gene, inactivate an improperly functioning gene, or introduce a new gene into a patient’s body to help fight a disease. Today, there are four main viruses used as biotherapeutic vectors: retroviruses, lentiviruses, adenoviruses, and adeno-associated viruses. Each of these viral vectors comes with its own limitations and advantages.

A number of drawbacks associated with viral vectors have led to the study and development of non-viral vector solutions for gene therapy delivery into target cells or tissues. These drawbacks include manufacturing bottlenecks, upscaling challenges, cancer-causing mutations, and immunogenicity of viral vectors.

Non-viral administration methods can address a number of these limitations, especially those associated with safety. Synthetic gene therapy delivery vehicles, for example, usually have lower immunogenicity than viral vectors because patients will not have pre-existing immunity, which is the case with some viral vectors. Many non-viral vectors are also easier to manufacture and can deliver much larger genetic cargoes than some viral vectors.

Despite these advantages, very few of these non-viral vector solutions are actually used in the clinic, as they have their limitations. The main challenge currently facing non-viral vector solutions is the effective delivery of genetic material into mammalian cells due to many barriers, such as potential vehicle degradation before it can even reach the target cell.

The Gene Therapy Market was estimated to be $ 4.2 billion in 2021 and is poised to grow at a CAGR of 26% by 2027 to reach $ 14.8 billion.

Investment in research and development (R&D) activities are also expected to have a significant effect on the market. Several companies aim to build a gene therapy platform with a strategy focused on establishing a transformational portfolio through in-house capabilities and enhancing those capabilities through strategic collaborations, expansion of R&D movements, and potential licensing, merger, and acquisition activities.

Based on indication, the market is segmented into neurological diseases, cancer, hepatological diseases, Duchenne muscular dystrophy, and other symptoms.

The global gene therapy market is highly competitive and consists of a few major players. Companies like Amgen Inc., Bluebird Bio, Gilead Sciences, Inc., Novartis AG, Orchard Therapeutics, Sibiono GeneTech Co. Ltd., Spark Therapeutics (Roche AG), and UniQure N.V., among others, hold the substantial market share in the Gene Therapy market. They have various strategic alliances such as collaborations and acquisitions along with the launch of advanced products to secure their position in the global market.

In Europe, there are more than 300 biotech and pharma companies working in the gene therapy field, while there are over 600 in North America, according to GlobalData. A large number of small and medium-sized biotechs are developing gene therapies, and numerous big pharma companies are also working in the field, as mentioned earlier.

1) Challenges to realizing the potential of viral-vector gene therapies:

The current generation of viral-vector gene therapies represents the culmination of decades of biological and clinical research. As more patients have received these therapies, it has become clear that three fundamental challenges will restrict the applicability of viral vectors: getting past the immune system, lowering the dose, and controlling transgene expression. Ongoing work to address these challenges is generating technological innovations that have the potential to leapfrog current therapies and unlock the potential of viral vectors.

To tackle gene therapy hurdles, academic labs, start-ups, and established companies are generating various innovative solutions. Each focuses on a specific component of a gene-therapy product (for example, the viral capsid) or part of the development process (such as manufacturing). However, these creations often address considerable core challenges, outlining multiple paths to realizing the promise of viral-vector gene therapy.

Future trends:

The manufacturing challenges:

As explained above, the early stages of gene therapy development involve continuous biophysical analyses and safety testing of the therapy’s viral and genetic components to ensure the safety and efficacy of the treatment when used in humans. However, challenges also pop up throughout different stages of the gene therapy manufacturing process.

Another challenge related to process development is the fact that each disease and each target tissue requires a different dosage.

Moreover, a lack of optimized processes and fast testing is seen as one of the main drivers of the high costs of gene therapies. To address this problem, researchers are working on the development of new analytical methods like robust, fast, easy-to-use, and reproducible assays. These should be developed only for gene therapy assessment rather than being borrowed from traditional antibody development processes, as is currently the case.