Author | Source

Severin Renold

Weissknight Corporate Finance

Severin Renold

Weissknight Corporate Finance

Real Estate, Mobile Housing

Real estate is a significant component of the economy’s capital stock and households’ wealth, which serves as both a crucial input for producers and providers of residence. Investment in real estate can be categorized according to its use as either commercial or residential.

As a result, the construction sector lies in an influential position as a significant contributor to the business cycle.

The construction industry, and its broader ecosystem, are the foundation of our economies and are essential to our daily lives.

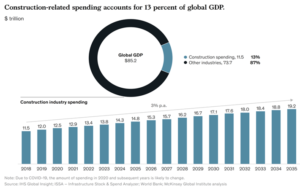

Construction, which encompasses real estate, infrastructure, and industrial structures, is the largest industry in the global economy, accounting for 13% of the world’s GDP.

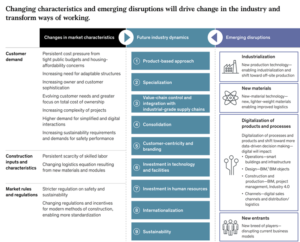

The lagging performance of the construction industry is a direct result of the fundamental rules and characteristics of the construction market and the industry dynamics that occur in response to them. Cyclical demand leads to low capital investment, and bespoke requirements limit standardization. Construction projects are increasingly complex, and logistics must deal with heavy weights and many different parts. The share of manual labour is high, and the industry has a substantial shortage of skilled workers in several markets. Low barriers to entry in segments with lower project complexity and a considerable share of informal labour allow small and unproductive companies to compete. The construction industry is extensively regulated, subject to everything from permits and approvals to safety and work-site controls, and lowest-price rules in tenders make competition based on quality, reliability, or alternative design offerings more complicated.

The construction industry was already starting to experience an unprecedented rate of disruption before the COVID-19 pandemic. In the coming years, fundamental change is likely to be catalyzed by transformations in market characteristics, such as scarcity of skilled labour, persistent cost pressure from infrastructure and affordable housing, stricter regulations on work-site, sustainability and safety, and evolving sophistication and needs of customers and owners. Emerging disruptions, including industrialization and new materials, the digitalization of products and processes, and new entrants, will shape future dynamics in the industry.

Customers and owners are increasingly challenging, and the industry has seen an influx of capital from more savvy customers. Client demands are also evolving regarding performance, TCO, and sustainability: smart buildings, energy and operational efficiency, flexibility and adaptability of structures will become higher priorities. Expectations are also rising among customers, who want simple, digital interactions as well as more adaptable structures.

Towards a zero-emission, efficient, resilient building and construction sector.

The EU Member States retain the competency to regulate issues such as safety, indoor air quality, noise and radiation. They also have the responsibility to implement European legislation. Local authorities have an essential role to play in the promotion of low-carbon and resource-efficient cities, building on the involvement of stakeholders and citizens.

CO2 emissions from the building sector are the highest ever recorded:

This industry must eliminate all CO2 emissions from the built environment by 2040 to meet 1.5° climate targets.

Development and implementation of new technologies are needed to reduce the demand for construction materials and enable their circularity and contributions to resilience.

Adopting offsite (modular) construction for disassembly and enhancing additive manufacturing with closed-loop materials for waste avoidance will further result in material efficiencies.

Offsite manufacture for construction is a manufacturing-based approach involving the production of components of buildings (e.g., foundations, roof cassettes, walls, floors, kitchen, and bathroom units) or whole (modular) units of a building in a factory for installation on-site. Offsite construction manufacturing is increasingly associated with greater use of digital technologies at different process stages.

The need to address sustainability challenges has been brought to the fore on the agenda of the whole sector. Emphasis on energy efficiency standards, and commitments to reducing carbon emissions across the construction industry, also derive from the world’s leading governments’ commitment to achieving carbon net-zero by 2050.

There are numerous benefits of non-traditional and offsite construction, including the speed of on-site operations; fabrication quality; safer working conditions; material efficiency, reduced waste; and less noise and disruption for residents and neighbours:

The potential for offsite and modular technologies to help tackle the problems related to the housing crisis and open up opportunities for advances in the construction sector is widely recognized. These innovations could deliver faster construction speed, better quality of housing and could provide a ‘golden thread’ of information needed for effective management and maintenance of housing.

Tiny homes are full-fledged dwelling units that are less than 500 square feet and have the basic amenities of a permanent home. They have evolved over the recent decades and come in many styles and designs, appealing to people from all walks of life, retirees, starter home-seeking couples, and minimalist young people, among others. Tiny homes offer a wide range of quality, affordable, and environmentally friendly housing that can be used to meet personal dreams, financial and lifestyle goals, and community needs.

The market share is expected to increase by USD 3.57 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 4.45%. In 2022, North America is expected to dominate the market due to changing lifestyles and the rise in investments and initiatives towards the construction of tiny homes for both commercial and residential.

The key factor driving growth is its affordability by the mass section of the population. Tiny homes are recognized as the most affordable housing system, preferred especially by millennials as recent studies show. Tiny homes are just a fraction of the price of traditional homes and can be designed based on customers’ requirements. Increasing usage of tiny homes in tourism activities is another important driver for the global tiny homes domain. The rising inflation leading to a rise in living costs and the increasing popularity of affordable housing solutions, and the tiny-house movement are expected to propel the development of the global sector.

Tiny homes do not require permits in many parts of the world as they are considered vehicles depending on their size and specificities. Many families have invested in tiny houses and then rented them to people. Some service providers even rent their tiny homes in various architectural and decor styles. These styles depict modern or minimalist to rustic or traditional as a unique alternative to the hotel stay. They equip the tiny homes with a kitchen, living space, bathroom, and sleeping area. Various factors, such as globalization, internet penetration, and growing social media influence, have boosted the demand for tiny homes. Furthermore, new lifestyles, higher disposable incomes, and increasing consumer environmental awareness create demand. This, in turn, is expected to act as a driver for the growth of the global market in addition to the recently emerging trend for mobile houses, which are easier to set up and dismantle and therefore also offer short-term possibilities for use.