Author | Source

Severin Renold

Weissknight Corporate Finance

Severin Renold

Weissknight Corporate Finance

Luxury and Watch Market

In the past year, the value of the US dollar has risen against most major currencies, driven by the relative strength of the US economy, the expectations of tighter US monetary policy and other known factors.

The global luxury goods sector is expected to grow more slowly in 2022, at a rate many retailers may find disappointing. The growth rate is slowing in important markets such as China and Russia, although some markets continue to perform well, and there are pockets of opportunities across the globe. India and Mexico for example, are proliferating, and the Middle East offers further growth potential. The European luxury goods market has bounced back since the difficult days of the middle of 2010-2020, but national economies are growing at different rates. Overall, market growth is slow but steady, with both domestic shoppers and wealthy tourists cautious about spending.

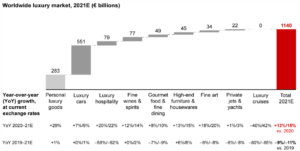

The global luxury market exceeded €1.1 trillion in 2021 – a strong growth of more than 15% following the contract in 2020 due to the pandemic.

The Global Watch Market was valued at $ 93 billion in 2021 and is projected to register a CAGR of 5.02 % during the forecast period (2022-2027).

China, Japan, and India significantly contribute to the sheer market value of the watch in the Asia-Pacific region. China is one of the most competitive markets in the world, as it offers enormous potential for manufacturers of luxury watches to acquire and compete. China accounts for over half of watches exports in the world in 2020 as per ITC Trademap. Rolex, Omega, Patek Philippe, Cartier, Channel, Longines, Tissot, Rado, Blancpain, and Piaget are some of the prominent luxury watch manufacturers having presence in the region. These Swiss watches are loved across the globe; in 2021, it witnessed a growth of 3.5 % in watches exports when compared to 2019.

There is no official data on the world’s production of watches. If it can be estimated at about 1.3 billion pieces, export and import results are higher because a product may be re-exported and thus be counted twice. However, these data reflect the forces involved very well and help identify trends facing the industry worldwide.

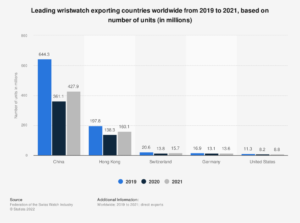

Only a handful of countries dominate the global watch industry. Ten countries – Switzerland, Hong Kong, China, Germany, France, Singapore, Italy, Japan, the US, and the UK – account for more than 90% of global exports of watches and watch parts, the first three being way ahead of the others. The fact that these 10 countries are simultaneously the most significant importing countries is evidence of the high degree of interdependence between their watch industries. The individual countries are, to some extent, specialized in different watchmaking products and steps in the production process.

Leading watch-exporting countries worldwide in 2019 & 2020, based on the number of units

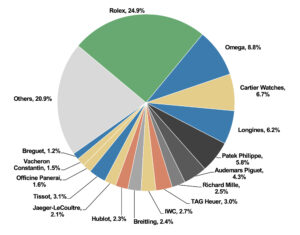

Between them, the Swatch Group, Richemont and Rolex constitute about 50% of the global watch market and are considered key players in the industry. Fossil (USA) is in the fourth position; it overtook the place of LVMH. The three largest Japanese watchmaker players (Citizen, Seiko and Casio) have 10% of the market share, having still fewer shares than Rolex alone.

Estimated market share of the leading watch brands worldwide in 2020

Watch-making is divided into two distinct branches: luxury watches (Haute-Horlogerie) and the fashion segment (low-end).

In order to understand the strategic choice of watch companies of where to produce and what key factors should be analyzed, the process of making a watch needs to be defined. When a company decides to delocalize or change its centre of production, there is always a reason why it is done. First of all, every watch needs to be elaborated on computer design. Major brands, including Rolex, Swatch, and Patek Philippe, have their own design offices within their company, but small independent design companies exist for brands that decide to outsource their design phase. Raw materials that can be used vary from the quality and price of the watches. Basic and low-end watches are made of plastic, titanium, or stainless steel, whereas luxurious watches are made of silver, gold, carbon, diamond, platinum, or ceramic. Thus, raw materials need to be accessible on the production/manufacture site. The manufacturing process is one of the most important steps and is divided into two phases. The first one is about shaping and tailoring the components of the watch. It can be hand-made or machine-made. The second one, which is the most noteworthy because it requires excellent knowledge and skills, is the process of manufacturing and assembling the watch components. Labour must be qualified to operate on specific machinery to shape particular parts. Thus, the location of this manufacture must be studied very cautiously because of the need for skilled labour and the availability of adequate machinery.

Quality control is the last step before the watch is shipped to retailers. It consists of checking possible defects to ensure high quality. This control can be made at the end of the production line for small and low-end watches, but the most luxurious and essential brands set the control at the earliest point of the manufacturing process.

The Great Hong Kong region clock & watch industry is the most crucial key player in the industry together with the Swiss one. Yet, a difference lies between production and sales. If the Great Hong Kong region is perceived as a competitor in terms of brand production in Switzerland, it is not the case in the retail sector as it is the largest market for Swiss brands, which realize the majority of their sales there (in Hong Kong only). Chinese domestic firms aiming to compete in the low-end segment want to upgrade their production to move to the middle and high-end verticals.