Author | Source

Severin Renold

Weissknight Corporate Finance

Severin Renold

Weissknight Corporate Finance

The event industry

Just like society, the event industry is always on the move, and event industry trends always reflect this. It has been proliferating.

The global events industry size was valued at $1,100 billion in 2018 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 10.3% to reach $2,330 billion by 2026 (Allied Market Research, 2019).

Events can mean anything from a large music festival to dinner with just a few people. In this context, we focus on the business event industry where the attendees are participating in their professional roles. Business events also include all types of inter-organizational conferences or internal gatherings within the public sector sphere that are not per se business-related but has the same characteristics that the attendees meet in their professional capacity.

Within this space, there is a number of different types of events that vary in their purposes, objectives and stakeholders – as well as in length, size and format.

Structure of the corporate events’ industry:

Likewise, in other industries, the conference industry consists of buyers and suppliers. The buyers are usually event managers and organizers, who are ‘buying’ venues, technical support and other services to conduct a conference.

Events are, by definition, occurrences where a number of people gather at a particular time and place. However, this does not mean that event organizing is a singular happening, organized ad hoc as a one-time occurrence. Organizing events is one of the critical ongoing responsibilities for a marketing department and often represent one of the largest budget areas in the marketing budget. Also, the Human Relations department often spend time, money and energy on organizing internal events and employee development throughout the year in order to build culture and team.

Among different methods of communication, events are the most powerful ones.

Most business events have an objective oriented around that attendees should feel, do or learn something. To achieve that goal, it is of high importance both that the aim is clearly stated, that the methodology, dramaturgy, agenda and topics are tailored towards that objective – as well as making sure to involve and engage the attendees. Put in other words: The important thing is not to get the message out to the audience but that it actually stays in the attendees’ heads.

As in all other aspects of our life, mobile technology, and instant access to information through the internet dramatically impact the event market. Event technology is since many years an essential integral part of almost all events.

There is significant overlap among products where several niche functions can be included in an EMS or an event app.

Trends before March 2020:

These are some of the trends observed prior to the covid crisis:

Engagement is one of the crucial aspects for event planners and one of the most important things to consider as it is a key to successful events.

Technological trends are modifying the whole events industry from different angles.

Overall, event app adoption rates are very high nowadays, with nearly 40% of app developers stating an adoption rate of over 80%. Another 35% of developers are claiming an adoption rate of 60% to 80%. This is a fundamental metric in the industry, as apps are the results of time and money investment. High adoption rates suggest that the app works out for many clients.

Conclusion:

Event Technologies are developing quickly and playing a pivotal role in the Event Management processes.

Events and, consequently, the event industry was obviously very hard hit by the covid crisis. No in-person events could be done, planned events were cancelled, and the whole industry was initially turned upside down.

Reed Exhibitions released recently its first’ COVID-19 and how it’s changing the Event industry’. Among its key findings, the Reed Exhibitions COVID-19 barometer reveals that:

Another study (EventMB’s State of the Event Industry, Dec 2020) shows that In terms of hybrid events, almost three-quarters of planners (71%) plan to continue to employ a digital strategy to maintain their virtual audience once they return to physical events.

In summary, most analysts foresee that:

The conclusion is that the trends before the crisis (more investments in event tech but with cost-conscious buyers) combined with the urgent need to cater towards the new post-pandemic market will create a strong force towards providing all-in-one solutions that can meet the needs of all types of event formats to an attractive price point.

In the same way, it means that the pandemic’s superstars, the online event platforms such as Hopin and On24 that have seen massive booms, will need to move towards in-person and hybrid events to meet the same need.

Consolidation remains a macro trend in event technology that will continue in 2022. With many small businesses incapable of weathering the coronavirus storm, it is widely anticipated that this trend will grow even stronger in 2022.

Severin Renold

Funding Trends – RegTech Market

RegTech has continued to grow in popularity over the years, leading to more and more companies investing in this area. According to different studies, the RegTech market is expected to grow to over $12.3 billion by 2023. However, this article focuses on RegTech investment 2021 and RegTech funding 2020 + 2021.

RegTech funding reached a five-quarter high in the second quarter of 2021, with half of the total transactions exceeding $25 million.

In the first three quarters of 2020, RegTech investments were down but still higher than in 2019, but experienced an upswing in the final quarter of the year, recording a 39% increase in total deals.

Compared to the third quarter of 2020, the total amount of RegTech funding in 2021 increased by USD 1.9 billion. Around USD 4.3 billion was raised in 100 deals in the first quarter of 2021 and USD 4.9 billion in 122 deals in the second quarter.

Around 45% of their deals were $25 million or more in the first half of the financial year.

These figures suggest that their investors were more willing to write bigger cheques after the pandemic. In the first half of 2021, the percentage of deals of $50 million and above was 27.7%, which is the highest percentage for deals of this size.

This is mainly due to the trend towards maturity in the RegTech industry. New technologies such as artificial intelligence and cybersecurity, which have driven innovation in the industry, are reinforcing the upward trend, contributing to the maturity of the RegTech industry as a whole.

Compared to 2020, deals worth $25 million to $50 million have doubled. In the first half of the year, 45% of all deals were $25 million or more.

Eight of the ten largest RegTech transactions globally in the first half of 2021 were from North American companies.

North America is currently the dominant RegTech funding region, with eight out of ten deals completed in the first half of 2021.

This accounts for 65% of all deals in the first half of the year. After North America, Europe accounted for 23% of deals completed in the same period.

Cybercrime is one of the biggest threats to the financial industry. For this reason, five of the top ten RegTech companies in the first half of 2021 were active in the cybersecurity subsector.

In the first half of 2021, for example, Transmit Security, a Boston-based company, and Synk were part of media-effective deals.

In the first half of 2021, New York was the city with the most RegTech deals.

In a breakdown of the top cities that showed increased RegTech activity, New York was number one, closely followed by London and San Francisco. Of the 174 RegTech deals, New York accounted for 24, London 22 and San Francisco 21.

The growth in RegTech investment 2020+2021 and RegTech funding 2021 clearly show that the industry continues to be on an upward trend and is gaining increased relevance globally.

Severin Renold

Federal reports

Postulate / Motion National Council

Canton Zug

Startups Switzerland | Zug

The thematic focus of this research work is directed at the framework conditions and funding instruments of a location, which can have an influence on the founding and success of start-ups. The aim is to find out which of these factors have a positive influence on the choice of location and to be able to distinguish them from the influence on success in a differentiated approach.

To this end, a literature search is conducted at the outset and sources on entrepreneurship, the development process of a firm and the underlying conditions for a desirable realisation of the business idea are consulted. By delving deeper into the research context, it becomes apparent that a deeper level of abstraction will be necessary for further work in order to be able to make clear and valid statements later in the project. Works such as “Start-up and survival chances of family businesses” (Albach and Pinkwart 2002, pp. 21-54) speak of the required agility in a business and the ability to react quickly to external market influences. This goes hand in hand with the initial choice of a location that can guarantee political as well as legal security on a long-term basis. While other sources such as the book “Strategic E-Business” (Keuper 2001, p. 37-72) discuss competitiveness in the information age, the dilution of national borders and distribution channels and the increasing relevance of making processes digital and automated. Just as the positioning in a niche market, due to the increasing change in consumer behaviour from a seller’s to a buyer’s market. Whereby it is increasingly determined by the consumer what is to be offered and, conversely, due to new possibilities in the e-commerce sector, there is a flood of information and offers. For companies, this means focusing on the access to talent and new employees who can offer a connection to change and guarantee future consistency and innovative strength. However, when looking at other aspects such as the culture and risk appetite in a country, tax comparisons, training opportunities and the characteristics of the investor landscape, it becomes apparent that the scope of the study must be narrowed down, as the statements on the conducive framework conditions vary or are generalised depending on the interpretation and region. Accordingly, the author decides to focus future research purely on funding for start-ups. For this purpose, these are defined by their science- and technology-based approach, their focus on innovation, a scalable business model, return-oriented investors and a maximum duration of five years since foundation, based on the description of a startup by the “Swiss Startup Radar” (Baldegger et al. 2020, p. 9).

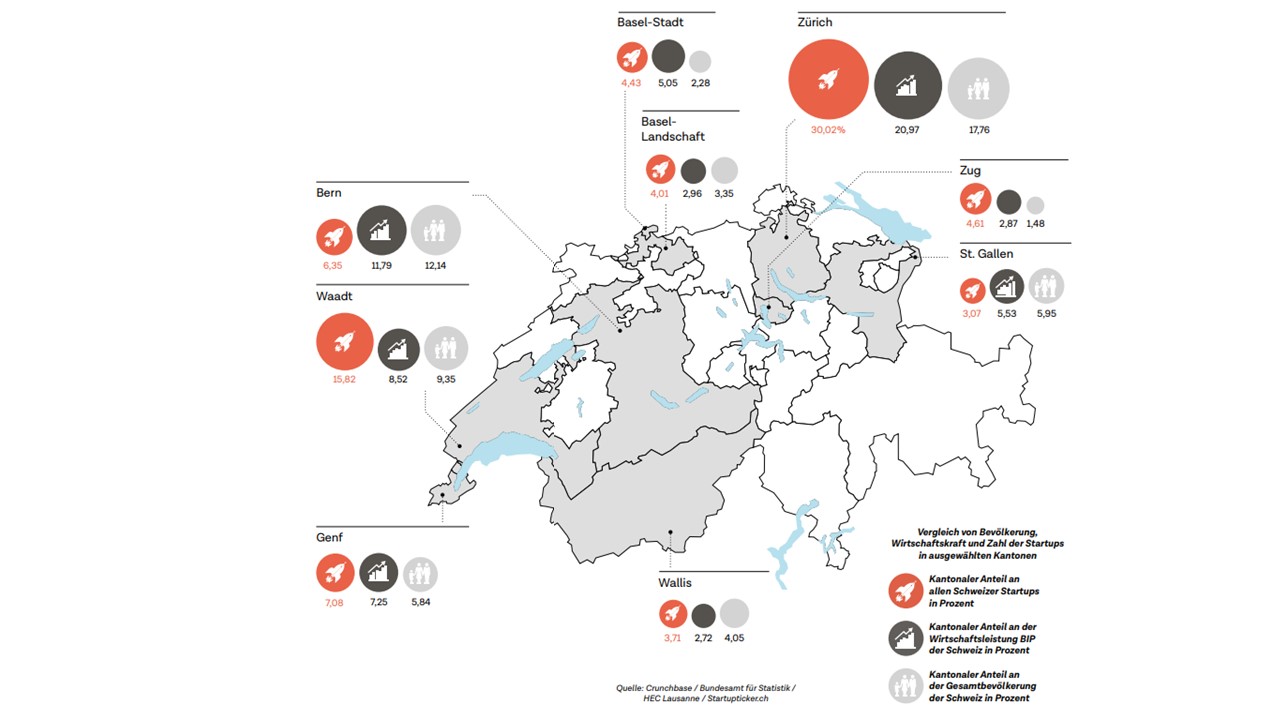

Furthermore, the research work is narrowed down geographically, using Switzerland as the basis for the international comparison and specifically the canton of Zug in the national comparison. Zug was chosen on the grounds that the canton has had an extraordinary media presence in recent years and has an above-average start-up rate. This can thus be used as a reference example in comparison with theoretical statements at government level and a standardised research methodology that follows later.

In a next step, research is conducted at the federal level to find out more about Switzerland’s positioning and measures with regard to its start-up ecosystem. Here, a postulate by former National Councillor Fathi Derder with an appeal to the Federal Council regarding better development of innovative start-ups in Switzerland stands out (Derder 2013). In his appeal, the National Council states that both the founding and success rates of Swiss start-ups could be optimised and therefore a sound analysis and immediate measures should be implemented. The Federal Council approved the proposal and presented its opinion in its report on fast-growing start-ups published in 2017. Drawing on sources from the Global Entrepreneurship Monitor (Baldegger et al. 2020), the Swiss Startup Radar (Kyora et al. 2018) and in collaboration with the Department of Economic Affairs (SECO) (ECOPLAN et al. 2016), the Executive presents its assessments of the Swiss framework conditions and position in an international comparison. The conclusion states that Switzerland and its framework conditions range from good to very good. With a distinctive network of high-quality universities and colleges, it provides a widely diversified start-up hub across a large number of cantons. The analyses show both a healthy growth in the number of spin-offs, a broad range of future-oriented training opportunities, initiatives for government support programmes and administrative relief for start-ups, as well as attractive basic tax conditions. The Federal Council refrains from introducing and defining the official term ‘start-up’, as well as from establishing state venture capital funds to directly support start-ups. Rather, the Confederation is trying to better connect to European financing offers and ensure the regulatory framework conditions. Finally, in the dispatch on location promotion 2016-2019 (Sommaruga and Casanova 2015, p. 1), the Federal Council submits a motion to approve various federal resolutions. The reasons given for why Switzerland has comparatively fewer start-ups are the high per capita income, the labour force participation and the associated unattractive opportunity-risk distribution.

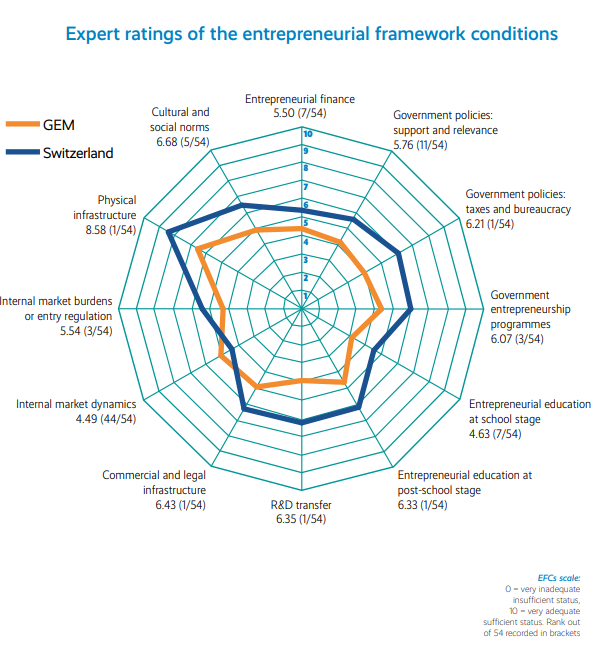

Based on these reports, reference can be made to a source that serves to interpret the framework conditions and presents a grid of a total of twelve condensed support instruments from the Global Entrepreneurship Monitor, called the National Entrepreneurship Context Index (NECI) (Baldegger et al. 2020, pp. 9-10). This will be used as a reference point in the later course of the work, supplemented and also used for the next step of the investigation. Some points from this index are the internal market dynamics of a place, the cultural and social norms, the research and development transfer or the commercial infrastructure.

With this knowledge, the next step is to take a closer look at the Canton of Zug. From sources such as the presentation on the business location from the Department of Economic Affairs (Department of Economic Affairs and Wirtschaftsförderung Zug 2020), the location analysis of the Swiss Brand Experts (swissbrandexperts 2010) and, derived from this, the government’s strategy for the legislative periods 2010 to 2018, the essential success factors are analysed according to the information provided by the stakeholders mentioned (Hegglin et al. 2010). In addition, interviews with start-up founders and government members are taken up to supplement the information obtained (Handelszeitung 04.01.2019). In addition to the overlap of some points from the report of the Confederation as well as from the NECI on the offer of public infrastructures and attractive tax conditions, this research finds some further aspects and soft factors that provide indications of possible research gaps and give rise to hypotheses. This concerns factors such as mobility and the centrality of the location as well as the slogan “The Spirit of Zug” (von Euw 2021), which is supposed to describe the entrepreneurial approach and the customer-centred, solution-oriented appearance of the public authorities. This includes the way of interacting with companies and thus also with start-ups, the stable policy and the innovation-driven mindset. It can be concluded that Zug places special emphasis on communication and marketing, which leads to the hypothesis of including these points separately in a future grid on enabling frameworks. In addition, the theory is established on the basis of the success example of Zug that existing promotional instruments are better used and thus the development of a location progresses all the more the more attention is given to customer-oriented communication. A final hypothesis is formed with regard to local venture capital agencies. After aggregating all sources and despite the partial neglect of the topic at the federal level, the theory is put forward that better access to venture capital in the canton will enable more start-ups to achieve long-term success.

With this foundation and prior knowledge, a standardised research methodology is finally arranged. For this purpose, a population of people is defined who are either already in the startup founding role, could found a startup in the future or have been active in a startup in a leading position in the past. The people must be able to establish a direct link to the canton of Zug if possible and are to be surveyed for just under a month by means of an electronic questionnaire. The chosen approach attempts to obtain the opinion of the directly affected target group in the startup question and to compare answers with the previously established and obtained theories. In preparation for the survey, the grid was further broken down and supplemented via the framework conditions and funding instruments NECI. It consists of about 26 items at the time of going live. Further parts of the survey arrangement deal with the location comparisons, the differentiation between the start-up and success factors, the topics of communication and risk capital, as well as with the Canton of Zug as an example of success. To ensure a subsequently valid answer to the research question and hypotheses, the survey must register at least 50 fully completed questionnaires by the final deadline. If the target is not met, Plan B will be implemented with at least 10 qualitatively guided expert interviews.

From 18 April 2021 to 9 May 2021, the questionnaire will be shared on social media, LinkedIn and via email and will also be conducted live with some participants. The analysis records 112 records at the end of the survey period, of which around 29 were submitted incomplete. The 83 complete responses can be used for the following discussion, with 47% (53 participants) being self-employed in terms of the total number and around 46% (52 participants) being involved in a start-up. The implementation of Plan B is therefore not necessary. Finally, the answers are compared in weighted form with the NECI of the Global Entrepreneurship Monitor, the federal resolutions and the strategy and analysis of the Canton of Zug. In order to answer the research question, a ranking of the ten most decisive factors for start-up founding and success in each case is created, consisting of the points with the highest agreement from the theoretical basis and the highest rating from the survey. The result shows that for both approaches the following points are of highest relevance:

Supply of and access to public infrastructure

On-site education and access to employees and talent

Local venture capitalists and access to public funding

Other congruent aspects with different prioritisation mentioned are fiscal framework, policy stability, legal framework, communication and interaction of authorities, quality of public transport and local business maintenance costs. The only difference in differentiation is item 10, where the number of industry-relevant associations and support programmes is mentioned for start-ups, while for start-up success it is the internal market dynamics that made it to the top ranking. Accordingly, these findings can be further used in the analysis and evaluation of supportive measures and will be discussed in more detail in the detailed research paper.

The hypotheses that have been put forward will also be addressed, starting with the theory that the more customer-oriented communication between the canton and the start-up is prioritised, the better the effect of the other support instruments and infrastructures will be. The question on the impact of customer-oriented communication on the participants shows that 65% of the respondents would make more use of existing funding instruments. Over 50 % would use more funding than before and would be more likely to found their startup in this location. Only 22 % of the votes declare an impact on the success of the start-up and less than 5 % of the respondents each explicitly affirm that customer-oriented communication has no impact on the points mentioned. Over two-thirds affirm the positive effect of speed of response on their decisions and success. Thus, the hypothesis cannot be falsified and remains valid until it is invalidated by a study with a more comprehensive population. As a further thesis, it is suggested that the point of communication must necessarily be taken up as a separate category in the grid of conducive framework conditions and instruments of authorities and governments. The results from the survey show a different picture here. While 92% agree on the relevance of communication and interaction during the start-up phase, only 26% acknowledge its importance for the further success of the company. The thesis is thus partially falsified and the recommendation is only for the inclusion of the communication aspect in the grid of conducive start-up factors. The last hypothesis states that better access to venture capital in a canton will enable more start-ups to achieve long-term success and retain their location. In the entire survey, this is where the clearest evidence emerges to verify the statement. Easy access to venture capital is rated as a decisive factor for success by 95% of the participants, 91% confirm the centrality via the number of regionally represented institutions with a need for investment, and for 88% the average investment volume also plays a significant role. The hypothesis cannot be falsified and remains valid for the time being.

From these findings, it can be concluded that the general framework conditions and funding for start-ups in Switzerland are basically positive, but that there is room for expansion and optimisation of various actions. These include the development of a new specification of the grid of funding instruments separated according to the start-up and success factors. As well as the establishment of standards in quality management and on the process of communication and interaction between authorities and start-ups. As well as the investigation of more attractive framework conditions that lead to the attraction of more venture capitalists and make access and administrative matters as simple as possible. The consideration must take place after a cost-benefit comparison, followed by a feasibility study and the subsequent definition of the scope. In further research, it is recommended to extend the survey period and the budget to incentivise participants in order to record a more comprehensive population and improve the participation rate. Furthermore, there are options to complement the previous research methods with qualitative interviews in order to gain further theories that have not been considered so far and to include them in the validation. In addition, new locations and startup hubs with similar success histories as the Canton of Zug (for example, Berlin) can be consulted for the direct comparison of findings in order to identify circumstantial evidence and to match research gaps such as communication in a different context.

Severin Renold

Corporate Finance

Mergers and acquisitions are a common occurrence in the corporate market and many of them take place every day. But despite the many mergers and acquisitions, there are not many long-term successes.

While most failures are due to market fluctuations or unsatisfactory company valuations, there are also some that occur due to cultural integration challenges;

– The obsession of the new company

This is an attempt to deliberately eliminate a company’s culture. All leaders must understand that every company has a culture that, like human DNA, identifies the company and is deeply rooted in the company.

In a merger or acquisition, it is impossible to completely eliminate a company’s culture. It is best if the executives agree on a common consensus and, depending on the size of the deal, some independence can still be granted.

– The ivory tower syndrome

This is the case when the merger or acquisition triggers fears for the executives’ careers. They fear losing their status, influence, power or job.

– The mirror effect

This is when the executives project their fears onto the employees of the company. For example, it would be possible for managers to be afraid of losing their jobs and to communicate to all employees that the mergers and acquisitions might force management to cut wages.

– The Road Runner and Wile E. Coyote scenario

This is about making hasty decisions and eventually falling over the proverbial cliff. In this cartoon, Wile E. Coyote could never catch up with Road Runner, no matter how hard he worked or who he hired.

The reason was that in his desperation he tried everything without considering how good his plans were. In some companies, senior managers might do the same thing by announcing acquisition decisions before they have consulted enough people.

– Problems leaving the company

This is the case when top management fails to support and reinforce their mid-level managers, who play an important role in managing the company and provide reassurance that they can continue to exist without key roles.

– The first spring flower syndrome

This occurs when top management prematurely proclaims the success of the merger. This can lead to employee frustration if it is not translated into reality to the desired extent or does not materialise.

How to avoid the problems

The best thing companies can do is to learn from the mistakes or successes of other companies that have done mergers and acquisitions in the past.

Severin Renold

Business models 2021

The biggest challenge for companies in this new world order is attracting new customers – especially in a “noisy” digital environment where billions of messages compete for attention every day. And since many companies cannot make enough money with their products or services alone (due to increasingly shrinking profit margins), other means in advertising and sponsorship are needed to stay afloat and sustainably profitable. Here are nine 2021 business models that could also work for your company.

1. micro-aggregators replace mass marketers.

Instead of dealing with a huge list of vendors and suppliers on their own (which can be very expensive), leading brands will increasingly outsource to micro-aggregators – specialist agencies that act as intermediaries between businesses and smaller companies that can provide niche services, products and content. Often these are offered as platforms or marketplaces for the purpose of increasing efficiency and providing a single point of touch.

2 Subscription commerce takes off

Retailers have struggled for years to find ways to compete with Amazon and connect online with customers who want products shipped directly to their homes instead of going to the local store. Here, too, new trends are emerging with the emergence of smart last-mile delivery and drop-shipping providers, to whom the otherwise very costly logistics issues for small businesses can be outsourced and the customer journey improved. In addition, this opens up new opportunities in the subscription sector and the associated customer loyalty.

3 Content is Key

Companies will increasingly rely on content marketing to attract attention and differentiate themselves in a world of supply and information overload where most consumers are “always on”. Here, companies will create and promote multimedia content such as articles, videos, podcasts, infographics and much more in order to be actively found according to the pull marketing principle. Consumers expect added value even before the first purchase, which is why it is important to build trust as early as possible.

4. the micro-subscription economy is exploding

Access rather than ownership is the new normal for many products and services in an ever-connected digital world where convenience takes precedence over ownership. Instead of owning their cameras or laptops, consumers will increasingly pay a monthly subscription fee to use a service provider’s products. This often involves rethinking insurance and quality management.

5 Smart data replaces traditional marketing strategies

Traditional marketing may have worked in the past, but today companies are more and more dependent on marketing their offers in an individualised and personalised way. This is precisely why data is gaining in importance and rather the intelligent implementation, pattern formation and integration into existing online sales strategies.

6 Mobile overtakes everything

Between 2016 and 2021, the number of mobile users is expected to increase by more than 33 percent. In comparison, internet usage via PC/laptop will only increase by six percent – a huge difference! With more and more people using smartphones and tablets as their primary means of accessing online content, businesses need to make this shift a priority if they want to stay relevant.

7. customer-generated content replaces advertising in print and TV media.

The traditional advertising model is dying as more and more customers cancel their cable subscriptions, unsubscribe from their daily newspapers and rely on online reviews when looking for new products or services. Collecting customer feedback through apps – either on your website or through third-party platforms like Facebook and Amazon – is a great way to target the right customers, track their behaviour and gain valuable data along the way.

8. The retail apocalypse is accelerating

Between 2011 and 2017, more than 21,000 shops closed permanently in America. This trend will continue to accelerate as brick-and-mortar retail continues its downward trend during and after the pandemic, according to various studies, and physical shops take a back seat to online shopping and alternative business models.

9 Fake news is just the tip of the iceberg

In a world where Fake News spreads like wildfire across social media platforms, fact-checking has never been more important. Companies need to equip their employees with tools to monitor and filter the vast amounts of information pouring in from all directions.

Final thoughts

As consumer behaviour changes, companies need to take a 360-degree view to establish their brand in the long term and adapt to trends of new generations and technologies. The last months showed best how important it is to be able to act agile and fast, to react to unpredictable market influences and to stand out in a jungle of online offers. Who knows whether personal contact will be desired more in the future to compensate for the online overstimulation. Until then, however, it is recommended to further expand the omni-channel marketing and distribution strategy.

Severin Renold

Culture and Diversity

Corporate culture has increasingly become a relevant concern for both employees and employers. The culture of an organisation determines how a company works and thinks. From the way different teams interact with each other and with customers, to the way processes and services are developed. A strong culture drives performance and enables high levels of engagement in the workplace. According to research, company culture is an increasingly important factor that employees see as a turn-off for a company before and during work – even ahead of pay.

The future of work is focused on diversity and inclusion of background in the workplace. Looking ahead, both are becoming key drivers in the development of positive cultures. Meaningful innovation is taking place in a variety of disciplines. Let’s take a look at some of the benefits of diversity and innovation in the workplace.

– It allows a company to use different strategies to solve problems

One way is creativity; using opinions from people of different ages, personalities and backgrounds produce innovative ways to accomplish different tasks in the company. It also has a direct impact on customer service, i.e. how employees serve their customer base. Diversity is the future of inclusive work, and it is an excellent way to foster innovation and improve organisational culture.

– It provides a safe environment

To protect and advance the innovation space in your company you need to create an environment where it is safe and allowed to make mistakes. The only way for a company to develop new ideas is to try other ways that sometimes don’t work. With a diverse workforce, everyone is involved and encouraged to think for themselves, to make rational or radical decisions and to make mistakes. For this reason, company owners should create space and tolerance for mistakes, initiate incentives and set an example to encourage innovation and progress.

– Encourage decision-making

When you have employees with different training and backgrounds, you can come up with better ideas and understand conclusions more clearly. You can also use new strategies for brainstorming, which often produce the best results. The process encourages decision-making and promotes independent thinking among the team in the workplace.

– Promoting an organisational culture

Diversity in the workplace doesn’t just hold a recent sales bonanza. It means bringing on board diverse employees who are united by sales goals – and also internalise a vibrant innovation environment and customer focus. This will ultimately lead to taking the company to a new level.

Final thoughts

In conclusion, diversity and innovation go hand in hand and no company can be successful without addressing these two aspects. They cannot be compromised, but rather are the foundation for successful businesses, especially in the workplace. Working in diverse teams is not easy, especially in the beginning, and requires everyone involved to adapt their working style and mindset to find consensus and compromise. However, this approach often leads to sustainable success, especially in view of the ever-present globalisation and international clientele.

Severin Renold

admin.ch

parlament.ch

booster, magazine for startups and investors

The FinTech market in Switzerland

Switzerland is a country with particularly good framework conditions for start-ups. A stable monetary policy, security, a functioning democracy, the tax regime and the flourishing economy are just some of the reasons why international companies repeatedly choose the small country in the centre of Europe. Particularly through the various industry associations or parliamentary initiatives such as the Derders postulate, the attention of the federal government is also increasingly focused on young, fast-growing technology companies and the measures that could positively influence start-up behaviour. Last but not least, the Federal Council’s report in 2017 shows that a lower start-up or success rate in international comparison (for example, compared to the USA or Israel) is not primarily due to the framework conditions, but rather to the high labour force participation and the good income opportunities in employment. This dilutes the option of starting an entrepreneurship due to the imbalance in the risk-reward ratio and thus fundamentally forms a barrier. This is a challenge that needs to be investigated, as it is ultimately start-ups and healthy competition that drive innovation in an economy and thus increase the prosperity of the population.

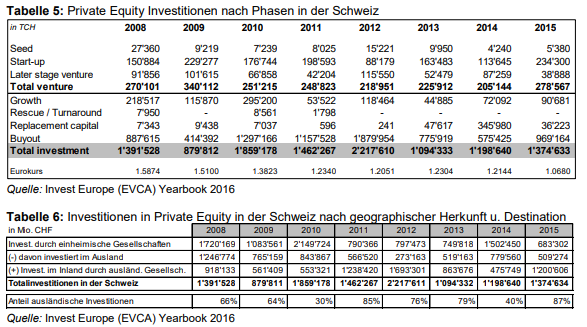

The fintech sector in particular has seen a lot of activity in recent years, with the canton of Zug, for example, registering a large number of new fintech companies and even being described as the new Crypto Valley by the community. This is the result of an entrepreneurial approach in dealing with administrative issues, according to the economic development agency. While other countries vehemently closed themselves off to the topic of blockchain and cryptocurrencies due to the novelty of the technology and many ambiguities, in Zug solutions were sought and attempts were made to create a suitable legal framework that meets the demands of all stakeholders. However, there is still a high exodus of start-ups that were able to successfully master the first 2-3 financing rounds and are now dependent on more capital for international expansion. Here, there are only a few venture capitalists (not only in Switzerland but in Europe as a whole) who continuously issue cheques in the CHF 20-50 million range, forcing such companies to turn their attention towards Silicon Valley or other venture capital-strong nations.

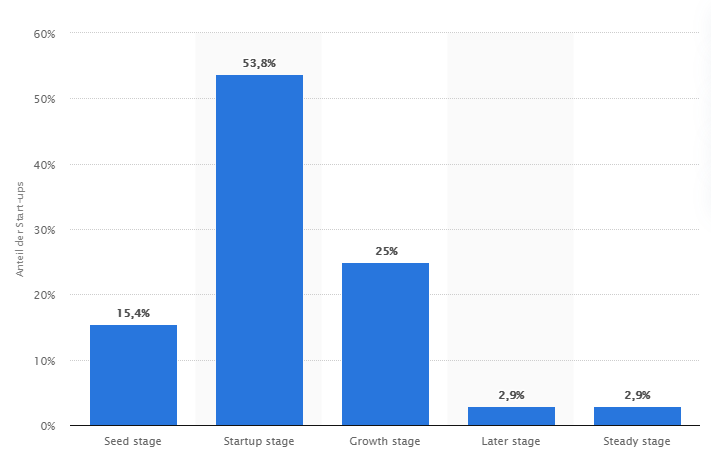

Looking at the statistics of the University of Duisburg-Essen from the European Startup Monitor 2016, we see that Switzerland has a high number of startups in the seed and startup stage. While this is basically positive and fuels competition, many jobs are created and profits are made in the subsequent phases, from which the national economy can benefit, new infrastructures are formed and the general quality of life is increased through investments at government level.

This does not seem to go unnoticed. Discussions are currently underway to improve access to European capital or to allocate local pension fund assets (at a very small percentage) to venture capital assets. In addition, various initiatives are being pursued to optimise the framework conditions for venture capitalists, for example by changing the taxation of company valuations, i.e. wealth tax, to a more income-focused taxation, which is not applicable to young companies in the first few years anyway. But direct measures are not being ignored either. For example, the State Secretariat for International Financial Matters has launched the Green Fintech Network together with industry representatives. Among other things, this is intended to strengthen the interplay between sustainable financial services and digital technology. According to the SIF, the most important players in the sector are represented in this network, including green fintech companies and associations, venture capital firms, universities and universities of applied sciences, as well as consulting firms and law firms. The mission of this network is to show in which areas the framework conditions for green fintechs in Switzerland can be improved.

But things are also happening on the corporate side. UBS, for example, is setting an example by founding UBS Next. UBS wants to work more closely with fintechs and the technology ecosystem. To this end, the big bank is setting up a new portfolio with around USD 200 million to invest in digital ventures. UBS mentions internal initiatives and existing strategic partnerships as possible cooperation partners. However, external cooperations with technology companies, start-ups, regulatory authorities and academia are also possible. The objectives of this launch include the co-development of digital innovations, modernisation and modularisation of technical equipment, the use of new technologies such as public cloud, microservices architectures and artificial intelligence. Priority will be given to UBS Next investing directly in early-stage fintechs, it says.

The basic movement is therefore promising and it is to be hoped that other large companies will follow suit and parliamentary proposals will be realised.

Severin Renold

Der Aktionär

Shares and Bitcoin

The stock exchanges are really revving up at the beginning of the new year. They seem positively liberated and buoyant. The start of the vaccinations against the Corona virus – albeit in some places in an unfortunate manner – the presidency of Joe Biden including the expected Green Deal, the continued loose monetary policy of the central banks: this mixture has a positive effect on the mood of many investors. Whether shares or bitcoin – the mixture seems to be having an effect across almost all asset classes. However, if you take a closer look, you will see the first serious signs of exaggeration.

The extent of the exaggerations becomes obvious when looking at the price trend of Bitcoin. This is the cryptocurrency that continues to divide opinion. Worthless bytes or a serious alternative to fiat currencies? The answer: the Bitcoin price recently doubled within a few weeks. It then fell again by around a quarter. But markets need to breathe. The faster they rise, the thinner the air becomes, the more threatening the height. That is why it is right and important that the participants give them a break now and then. To catch their breath, to catch their breath. Anything else would be unhealthy. The correction in bitcoin therefore came just in time. The price has risen too much in too short a time. The crash secures both: the profits of those who have now pulled the rip cord. And the chance to get in at reasonable conditions for all those who have been standing on the sidelines. Mixed signals were sent by the government or, for example, statements by Christine Lagarde, who is calling for better regulation of cryptocurrency. This confirms that the niche community is being taken more and more seriously, but it also spreads fear and uncertainty about future developments and restrictions on use.

Looking at the stock markets, individual cases give cause for concern. In the midst of it all, the richest person in the world. When Elon Musk recommended the messenger Signal, the shares of the eponymous company Signal Advance shot up 1100 percent. Those who invested here did not bother to check who was behind the messenger. At any rate, Signal Advance is not, and the hype around the share is completely unfounded.

Something similar can be observed in the hydrogen segment. The shares of good quality companies are rising rapidly. At least: this rise is accompanied by good news, such as the deal between Plug Power (the share has doubled in value since the turn of the year) and Renault. But the high interest of investors is now also being exploited by half-secret share promoters. The fact that it is enough to label a share with hydrogen to move it massively upwards can cause one some concern.

Severin Renold

Cryptocurrencies & Blockchain

Introduction

In order to show the derivation and explanation of private blockchains as comprehensibly and simply as possible, a comparison can be made with Bitcoin, the best-known cryptocurrency based on blockchain technology. With the idea of creating a completely decentralised and immutable system by replacing trust with cryptography, the pseudonym Satoshi Nakamoto launched the Bitcoin Whitepaper in 2008.

Consensus on a state is created through mining, the solving of cryptographic calculations, which due to their complexity works randomly in the form of “rates” and therefore speed and efficiency are decisive factors, which must be handled by computing capacity. Participants on the blockchain are identified with a public key and the log of all transactions is stored on decentrally distributed nodes so that it can be viewed transparently. In this way, the system offers almost 100 per cent anonymity, since people log on and interact with a number instead of a name, but also almost 100 per cent transparency, since all actions can be traced back to their origin. This state of affairs gives rise to the term pseudo-anonymity and is a thorn in the side of many users, as the ongoing digitisation and conversion to electronic money leads to an ever greater restriction of privacy, which is ultimately quickly associated with people’s fundamental rights. A conflict of interest arises here, as the government is pushing for the highest possible transparency in order to combat issues such as black money, tax evasion or terrorist financing, for example, but on the other hand there is the threat of a complete withdrawal of privacy.

This is one of the reasons why the privacy blockchain initiative came into being. These should make it possible to guarantee greater privacy with the same advantages of decentralisation and thus protect the fundamental rights of users. Interoperability is also optimised to some extent, which is related to the term tainted coins. To make the comparison again: A bitcoin is not fungible, so by definition it cannot be arbitrarily exchanged with another bitcoin, as is the case with simple cash and is a prerequisite for a properly functioning capital system. If, for example, a bitcoin originates from fraudulent activities or other questionable transactions, it is getainted (tainted) and is no longer readily accepted by the community, purely because it has lost value or is almost worthless due to the traceability of its origin. Thus, from time to time, the system becomes increasingly difficult and less scalable due to the limited number of flawless coins. With this background as an additional aspect, the two following privacy coins were set up in such a way that they are completely fungible, i.e. 100% exchangeable, and the transaction speed was also improved many times over in favour of higher scalability.

Monero

Monero is one of the previously mentioned cryptocurrencies that aims to solve the anonymity and privacy problem. The name is taken from the Esperanto language and means coin. Launched in April 2014, the code is based on a fork of the CryptoNote protocol Bytecoin, initiated by core developers, including the one known by the alias thankful_for_today. Monero uses the Proof-of-Work (POW) mechanism to build decentralisation and consensus, using RandomX, an ASIC-resistant and CPU-friendly POW algorithm developed by members of the Monero community to make it impossible to use mining-specific hardware. This makes it less compute-intensive but more memory-intensive and generally more decentralised. Previously, Monero used CryptoNight and variations of this algorithm. The amounts paid out as incentives for mining will be continuously reduced until the defined supply cap is reached, probably in 2022, after which the amount per block will be set at 0.06XMR. Anonymity and the real innovation of the technology behind Monero, however, is hidden in the ring signature (RingCT). Here, a number of users are grouped together per block, who sign part of their own transaction as well as part of the transactions of the other block participants. Seen from the outside, it can be confirmed that the transaction total is correct and can be verified, but not who sends which amount to whom exactly. Parts of the most diverse signatures thus merge per transaction into a unique, unmistakable signature to guarantee privacy. Neither the sender nor the recipient nor the respective transaction amount can be determined by the additional concealment using stealth addresses.

Dash

Dash is also a so-called privacy coin, which was created in 2014 from a fork of Litecoin. Dash stands for “Digital Cash” and, as the name already suggests, the cryptocurrency is primarily intended to be used for everyday payment transactions. Dash relies on POW as the consensus mechanism, whereby the chained hashing algorithm X11 is used. In addition to the miners, the so-called masternodes (>1000 DASH) also ensure security in the network. For example, they vote on the further development of Dash and receive a share of the mining revenue for their efforts. Furthermore, the masternodes enable anonymous transactions through the “PrivateSend” function, which is also a central function of Dash. The masternodes act as a kind of “mixer”, whereby “PrivateSend” transactions enter the masternode pool and are mixed with the deposited coins. Another type of transaction offered by Dash is called “InstaSend”. With it, payments can be made within a few seconds, which would speak for an alternative means of payment. In order to constantly improve the blockchain, Ryan Taylor (CEO) and the Dash Core team need to be funded via the blockchain. This is done through mining revenue, which is split via smart contracts as follows: 45% Miner, 45% Masternode Reward (Proof of Service) and 10% Decentralised Governance Budget (Dash Core Team & Development). Compared to Monero, Dash is a bit more centralised as both a registered company and the CEO are publicly known and therefore vulnerable. In addition, Dash has a defined funding budget and also uses a large part of it for marketing purposes, whereas Monero and its projects are fully supported by the community and no fixed budget has been defined.

Conclusion

Are privacy coins good or bad? Opponents argue in response to this question that privacy coins can be used for illegal purposes such as money laundering, drugs or ransomware. This is undisputed and has often led to negative headlines in the past. Proponents, on the other hand, could argue that coins like Monero and Dash, besides solving the problem of fungibility, protect the privacy of users. Full transparency on the blockchain may have its advantages, but it also has its disadvantages. Privacy coins offer their owners a certain anonymity when using them, which is particularly important in very private matters. For this reason, private coins should be given their place in the crypto ecosystem and should also be considered in future applications. However, their existence is still highly questionable, with complications with governments or exchange delistings to be expected. In conclusion, it can be said that the technologies of privacy coins can have many different forms and their respective suitability depends on the exact use case. It is foreseeable that privacy coins will mainly be useful for a lead community, but rather unlikely for the broad mainstream.

Severin Renold

Prime Partners

Swissquote

The Swiss stock exchange and the development of various industries

The Swiss Market Index (SMI) has almost regained its former strength after the slump in March. However, the performance of companies varies considerably. After the massive decline in March, the SMI – the index of the 20 largest Swiss companies – has regained ground. At the beginning of June, it was already above 10,000 points, only 6% below the level at the beginning of 2020. By way of comparison, the leading Italian MIB index fell by 19% in the same period, the French CAC40 by 18.5% and the DAX in Germany by 9%. “The Swiss stock exchange is outperforming all the major markets”, says Eleanor Taylor Jolidon, Co-Head of Swiss & Global Equities at Union Bancaire Privée (UBP). What is the reason for this? “Companies from the US and Switzerland achieve the highest value creation worldwide,” Taylor Jolidon continues. “The environment is difficult for companies that rely on strong growth. This is not the case for most Swiss companies. I therefore expect the local market to continue to outperform.

Swiss companies are well-positioned to weather crises like this. “They are internationally oriented. This means that periods of economic weakness in individual regions are offset by developments in other countries. Companies that are present in many markets are better able to cushion crises,” explains Jérôme Schupp, a financial analyst at Prime Partners. “Moreover, Swiss companies are often market leaders or occupy a leading position in their segment, so there is no getting around them”. But not everything is rosy. “We have moved from exaggerated pessimism to a slightly too much optimism,” adds Jérôme Schupp. “The markets see the pandemic as a temporary crisis that will be followed by a strong recovery. But the difficulties are only just beginning. Eleanor Taylor Jolidon agrees: “The world economy is extremely fragile. Many people have lost their jobs – almost 40 million in the US alone – and I am not sure that they will be able to find a job quickly”, the UBP manager explains. “There is a lot of optimism in the markets at the moment, but I expect corrective movements and some painful surprises, followed by renewed euphoria”.

The current optimism is partly due to the company results for the first quarter of 2020. They turned out better than expected. “The markets are very emotional,” says Eleanor Taylor Jolidon. “They looked at the first-quarter results and concluded that not everything is so bad after all. But the most important thing is not the figures from the past, but future developments and especially those after the lockdown.

In a sense, the SMI occupies a special position. “This index is not representative of the Swiss stock market given the three heavyweights Roche, Novartis and Nestlé, which have outperformed the market as a whole during the crisis and have good prospects,” explains Jérôme Schupp. “If you look at the other companies in the SMI or all companies listed in Switzerland, the picture is more mixed. The operator of duty-free shops at Dufry airport, for example, has been severely affected by the coronavirus pandemic and its revenues have fallen to almost zero (-94% in April). Logitech, on the other hand, managed to increase sales of webcams by 32% and accessories by 60% during the corona restrictions. We should therefore not look so much at indices such as the SMI or at entire sectors. Investors should rather focus on companies that create value.

The pharmaceutical and food industries

It is not surprising that the pharmaceutical industry is doing well in times of a health crisis. Roche, for example, is making a name for itself through its expertise in diagnostics and innovative products and is thus proving crucial in the fight against Covid-19. The Basel-based company can also count on its drug Actemra, which is used to treat patients with severe lung complications. In May, Lonza signed an agreement with the US biotech company Moderna Therapeutics to help manufacture a vaccine against Covid-19. If successful, the Swiss chemical company, whose sales in the first quarter were up by more than 7.4% year-on-year, could become a key player in the production of the long-awaited coronavirus vaccine. Givaudan is also doing well. The Geneva-based flavours and fragrances manufacturer, whose Fine Fragrances business was affected by the crisis, switched part of its production to the manufacture of disinfectants early on. The food giant Nestlé benefited in the first quarter from customer stockpiling due to the corona pandemic.