Author | Source

Severin Renold

Weissknight Corporate Finance

Severin Renold

Weissknight Corporate Finance

Electric Vehicles

The automobile has long been regarded as one of the most important innovations in history, significantly changing people’s lifestyles, quality of life, and productivity. At the same time, the freedom to move, social status, and the fun of driving have fostered an automotive culture, making the automobile a particular consumer product rather than a simple transportation tool.

Transport is critical for the economy. It creates growth opportunities, generates jobs, facilitates trade and realises economies of scale. Mobility is central to the whole of society. It allows people to connect with places and shapes how we live our lives. In the last twenty years, social changes have significantly altered how and why we use the transport system; shifts will likely be even more notable over the next twenty years.

Changes such as the growing, ageing population will meet technological advances in electric power, digitalisation and automation. These technologies will bring opportunities, offer fresh innovation to existing needs, and radical new approaches. However, they will also bring challenges. Realising the full potential of technology requires us to consider how users’ travel behaviour will respond to it and how all of society and our economy can benefit. To be truly transformational, we need to view transport as a system: to consider it as a whole. The future of transport needs to balance a wide range of considerations. Capacity has a role to play, but it must be linked to making travel more sustainable overall, be this through lower emissions, less travel or better relating our journeys to housing and work.

The global automobile industry is on the brink of a vital transformation. Technology is driving this shift, shaped by demographic, regulatory and environmental pressures.

Before the COVID-19 pandemic shook up the automotive industry – along with every other industry – electric vehicles were moving steadily into the spotlight.

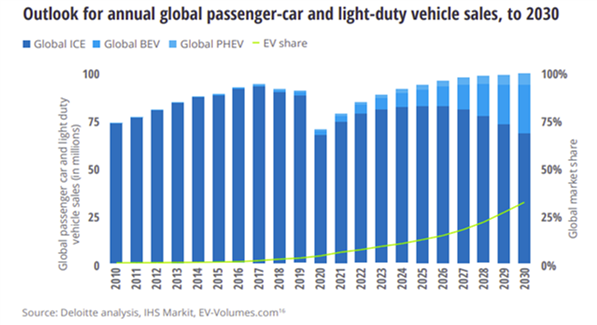

The combined annual sales of battery electric vehicles and plug-in hybrid electric vehicles tipped over the two-million-vehicle mark for the first time in 2019. EVs staked their claim on a 2.5% share of all new car sales last year.

In terms of volumes and trends:

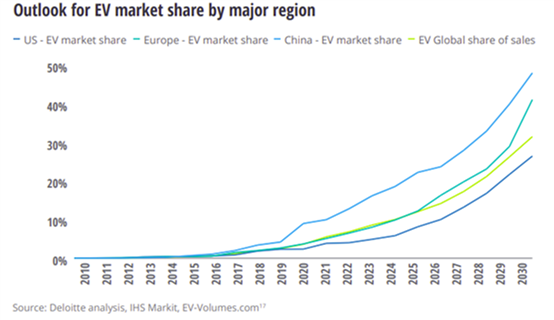

In terms of value and trends:

What is behind and driving this massive growth market:

Consumer demand will fuel the growth of EVs. As the barriers to adoption are rapidly removed, EVs are increasingly becoming a realistic and viable option.

From 2018 to 2020, there were some noticeable changes in consumer attitudes toward EVs. Concerns over the cost/price premium have diminished in every country. Driving range has remained the number one concern in Germany and became number one in France, but there are now fewer consumers citing it as a concern in those two markets. Elsewhere, the lack of charging infrastructure has become the top priority for consumers, reflecting the possibility that they are starting to see EVs as a realistic option and are considering the practicalities of ownership.

Over the next few years, experts expect some barriers to be completely removed. EVs’ driving range is already comparable to that of ICE vehicles; price has already reached parity if you consider subsidies in various markets and total cost of ownership, and the number of models available is increasing.

Government intervention continues to play an essential role in driving EV sales, as shown by the successes in Norway, fluctuating sales in the Netherlands and changing fortunes of the Chinese EV market.

Not only are there economic benefits for states that support a transition to electricity, but the positive environmental impact has made the widespread adoption of EVs a necessary step toward achieving climate-change goals, such as those of the 2015 Paris Agreement. Several policies and regulations are helping encourage the growth of EV adoption.

In the past year, some prominent OEMs have announced strategic commitments to EVs. New models have been announced, production targets increased, and sales targets moved forward and multiplied. The impact of the investment and targets will represent a seismic market shift over the next decade regarding the availability and affordability of models.

According to statistics cited by the European Federation for Transport and Environment, Europe should expect 33 new models in 2020, 22 in 2021, 30 in 2022 and 33 in 2023. This means that EV models available in the EU will surpass 100 in 2022 and reach 172 in 2025. In the United States, IHS Markit predicts 130 available models by 2026, offered by 43 brands.

The top 29 OEMs already plan to invest more than $ 300 billion over the next 10 years to develop capacity production further, and all of them make the claim they can do so profitably. Assuming that global weaning from fossil fuels continues, automobiles will contribute fewer greenhouse gases on a “well-to-wheel” basis over time.

Achieving price parity with, or even savings over, ICE vehicles will play a big role in speeding up EV adoption, especially as model ranges and marketing priorities adapt to manufacturer emission targets. Even with more OEMs offering affordable EV models, consumers are still unwilling to pay a premium for an EV instead of its ICE equivalent. However, experts expect the existing price premium associated with EVs to be consigned to history sooner rather than later.

Experts see an increasingly important role for corporates to support EVs’ transition, using the three factors highlighted above to their advantage.

Sales of new cars to businesses represent a significant proportion of all vehicles sold.

Compared to internal combustion engines vehicles, EV have a significant advantage – battery technology developments are faster than those of the engine technology on gasoline-petrol based cars.

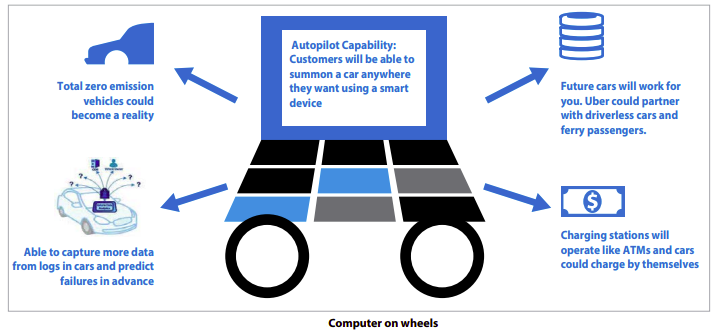

In addition, the trend of packing electronics in today’s automobiles shows that innovations in electronics will outpace other innovations. The amount of electronics in an EV is high compared to conventional vehicles. It offers opportunities for more innovations. The electric car of the future will be a proper computer on wheels and will change the automobile‘s character.

As an example:

The major shift within the automotive industry due to the growing part of EV is, therefore, the technology and innovations embedded into the vehicles.

With software and other technologies taking the lead, it’s no surprise that consumer tech companies are entering the automotive world. While a car may not be a mobile phone, these businesses’ focus on design, ease of use, automated assistance and battery life will bring new kinds of innovation to the field. One catalyst for tech innovators to move into the automotive industry now: electric vehicles have just 1/3 of conventional vehicles’ parts, lowering the barriers to entry.

The Internet of things has demonstrated how connecting everyday devices to a network could transform what we can do with them. According to several Tech specialists and automotive experts, the Internet of cars will do the same. Connected vehicles, communicating with each other and with the larger world, will not only reduce accidents and ease traffic, but they will also have powerful effects beyond the auto industry. Insurers, for example, will have new ways to monitor driver behaviour, reward good drivers and distribute costs to bad ones. And ride-sharing companies can better connect idle cars with the customers that need them.

Ridesharing may be a mixed blessing for the auto industry. The majority of vehicles worldwide are used only to commute or for short trips during the day, leaving them idle 95% of the time. Connected cars—especially self-driving ones—could also change the way people use their drive time.

There is a clear market window for low cost, electric city cars in Europe.

Improvements in battery technology have resulted in small and light electric vehicles (LEVs) appearing on the market in Europe since 2015. However, their market share is still comparatively small due to their excessive price.

Cities today face problems resulting from increased mobility needs, which are often still tied to private car ownership and auto-centric transport infrastructures that have grown historically.

A key element in urban mobility planning for many cities today is promoting ecologically, socially, and economically sustainable mobility options. Light electric vehicles (LEVs) are becoming an extensive element in sustainable mobility concepts within urban and rural areas.

City cars have historically been the low cost, entry-level vehicles in Europe, representing a consistent 8.5% of annual car sales on average (1.2 million vehicles per year).

New European emission standards have made this an unprofitable segment for most European OEMs, leading them to shift their A-segment vehicles to electric or discontinuing these models altogether.

On top, very important to realise that European car buyers have a strong preference for vehicle brands with a European country of origin.

Due to the higher prices of electric vehicles, early adopters of EVs have skewed affluent, with 60% of buyers having an average household income of over € 100,000 per year.

Only 13% of prospective car buyers in Europe are willing to pay more than € 2,000 more for an electric car vs a comparable petrol model.

Conclusion:

We live in a time of unprecedented change in the transport system. Changes in the nature of working and shopping, new technologies and behaviours – such as automation, vehicle electrification and the sharing economy – are already having an impact on how the system functions, while the intersection of the physical and digital realms is changing how transport is planned and used. These developments bring exciting possibilities which, if grasped, will bring significant social benefits.

The challenge facing cities throughout Europe concerning climate change, air and noise emissions are substantial.

Electro-mobility and small electric vehicles provide a significant opportunity to address the negative externalities associated with the internal combustion engine without constraining the vital role that vehicles play.