Author | Source

Severin Renold

Swissquote

Severin Renold

Swissquote

Microchips and geopolitics

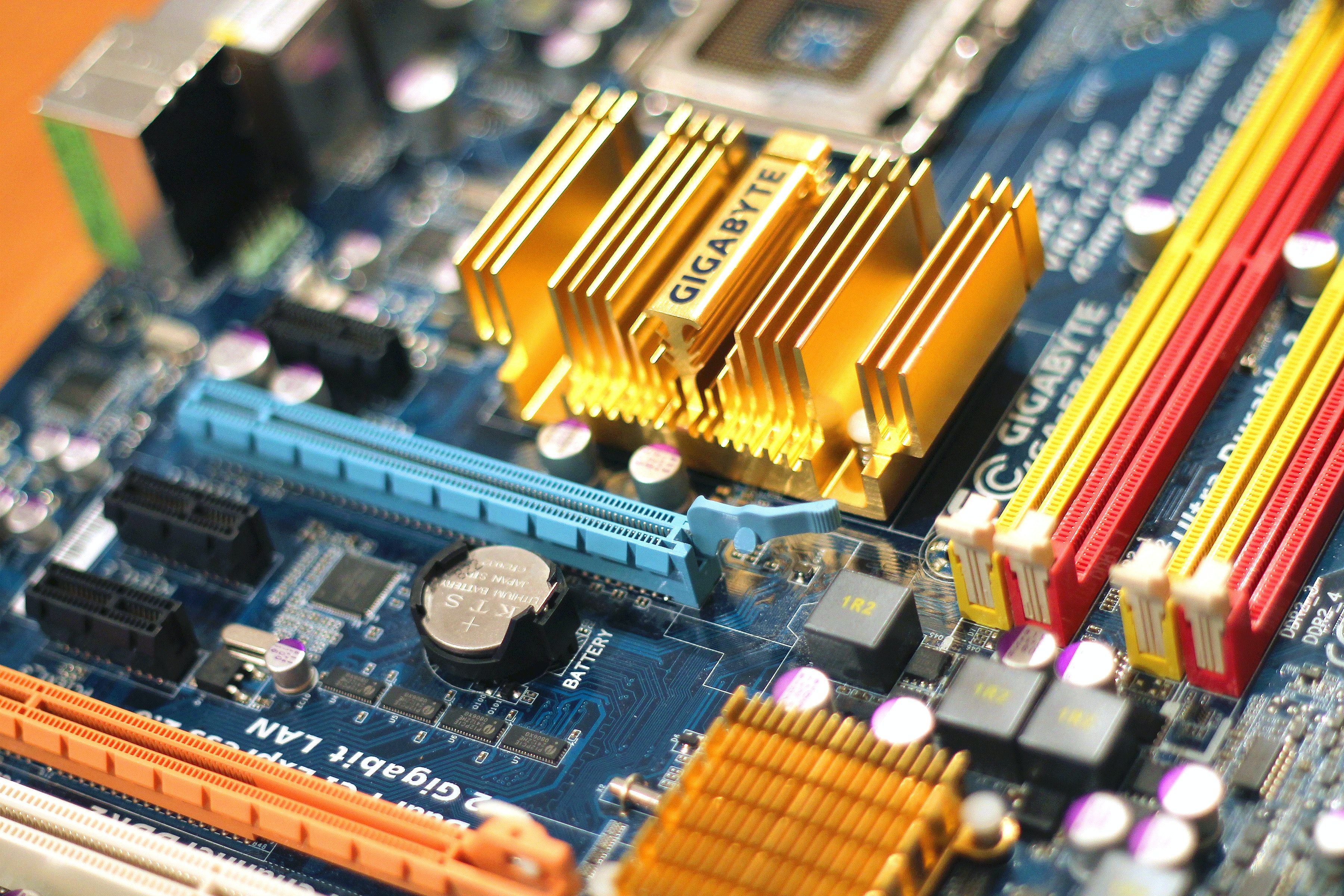

They are everywhere: in our house, our car, at our workplace and soon even under our skin. Ever since they first appeared in the 1950s, microchips have spread around the world. Chips are part of our everyday devices. Since 2018, more than one trillion chips have left the manufacturing plants every year – huge factories that produce semiconductors for every technology company, from Apple and Nvidia to Qualcomm and Huawei. And there’s no end in sight. The underlying trend for the next few years points to more and more semiconductors, according to Hugo Paternoster, industry expert at AlphaValue. “The more networked objects, including cars, the more chips will be needed.” Even though golden times are looming on the horizon, the semiconductor market is going through tough times. Even before the Corona crisis, the market experienced a disappointing year in 2019, with sales falling 12.8% to USD 409 billion.

Not as strong as in ten years. “The macroeconomic situation in 2019 was difficult due to slower growth in China, the Sino-American trade dispute and sluggish smartphone sales,” summarizes Frédéric Yoboué, industry analyst for the bank Bryan, Garnier & Co. “The reason why the price slump was so brutal was also because chip manufacturers had invested heavily in 2017, when semiconductor prices were at their highest. When demand fell at the end of 2018, they were left with far too high chip inventories and excess production capacity, which led to a sharp drop in prices.”

For everyone involved, the upturn was set to begin in 2020. In December 2019, World Semiconductor Trade Statistics predicted growth of 5.9% for 2020 and 6.3% for 2021, but then Covid-19 came along and ruined the good prospects. In a study published in April, the management consultancy McKinsey now assumes that demand for semiconductors will fall by 5 – 15% in 2020 compared with the previous year. Among the companies that will be hit hardest are those that manufacture microchips for smartphones (Qualcomm, MediaTek) or cars (Infineon, NXP). They are feeling the full force of the slump in production and consumption. Not least because consumers buy less technical “knick-knacks” in times of crisis.

The situation is completely different with players from the cloud industry or the emerging 5G standard, which will not only be important for mobile phone chips but also for autonomous vehicles. The electrification of vehicle fleets and their long-term automation are of enormous importance for the semiconductor industry. While today’s internal combustion engines contain chips worth about 370 USD, their electronic counterparts already contain chips worth 820 USD and can reach an estimated 2’000 USD for autonomous vehicles. In order to make vehicles autonomous, their capacity must be increased with the help of artificial intelligence, a sector which in the eyes of the semiconductor industry represents true paradise. According to market research company IHS Markit, sales of computer chips for artificial intelligence systems in all sectors (IT, healthcare, automotive, telecommunications, industry) are expected to triple in six years, from USD 42.8 billion in 2019 to USD 128.9 billion in 2025.

Who’s winning the race?

Donald Trum is not a geek. He’s a real estate developer. But the current occupant of the White House has no doubt understood how important the semiconductor industry is. According to him, the decision is clearly understandable that the USA wants to retain control of the development and production of these electronic components. The sector is dominated by US companies, and the trade war that President Trump is waging against the Chinese telecommunications supplier Huawei is primarily aimed at preventing Beijing from building up the necessary expertise. China may be the factory of the world, but semiconductors are still a weak point. In February 2019, the Center for Strategic and International Studies (CSIS) reported that China produces only 16% of the semiconductors used in the country. This is not enough to be independent.

But pressure from Washington may not have the desired effect. Instead of bowing down, China is now rapidly developing its own industry and investing huge sums of money. By 2020, the People’s Republic wants to produce 40% of all semiconductors used in the country itself, and by 2025 it wants to produce 70% of all semiconductors used in the country. The effects of this policy are already visible: HiSilicon, the semiconductor division of Huawei, made it into the top ten global chip manufacturers in the first quarter of 2020, according to CSIS. Until now, HiSilicon has only developed the chipsets and electronic components, with production then being handled by the Taiwanese group TSMC. In the meantime, however, HiSilicon is increasingly awarding its manufacturing contracts to SMIC, a Chinese company.

And what role does Europe play? The UK is home to chip specialist ARM, the Netherlands to specialist machine builder ASML, and Switzerland to technology company Comet – all top-class European companies that have mastered important areas of chip manufacturing. But it takes more than that to achieve the kind of leadership that the US has today and China is likely to achieve in the future.